Taking a look at the complexities of Venezuela’s economy, from hyperinflation to the practicalities of using bolivares and US dollars.

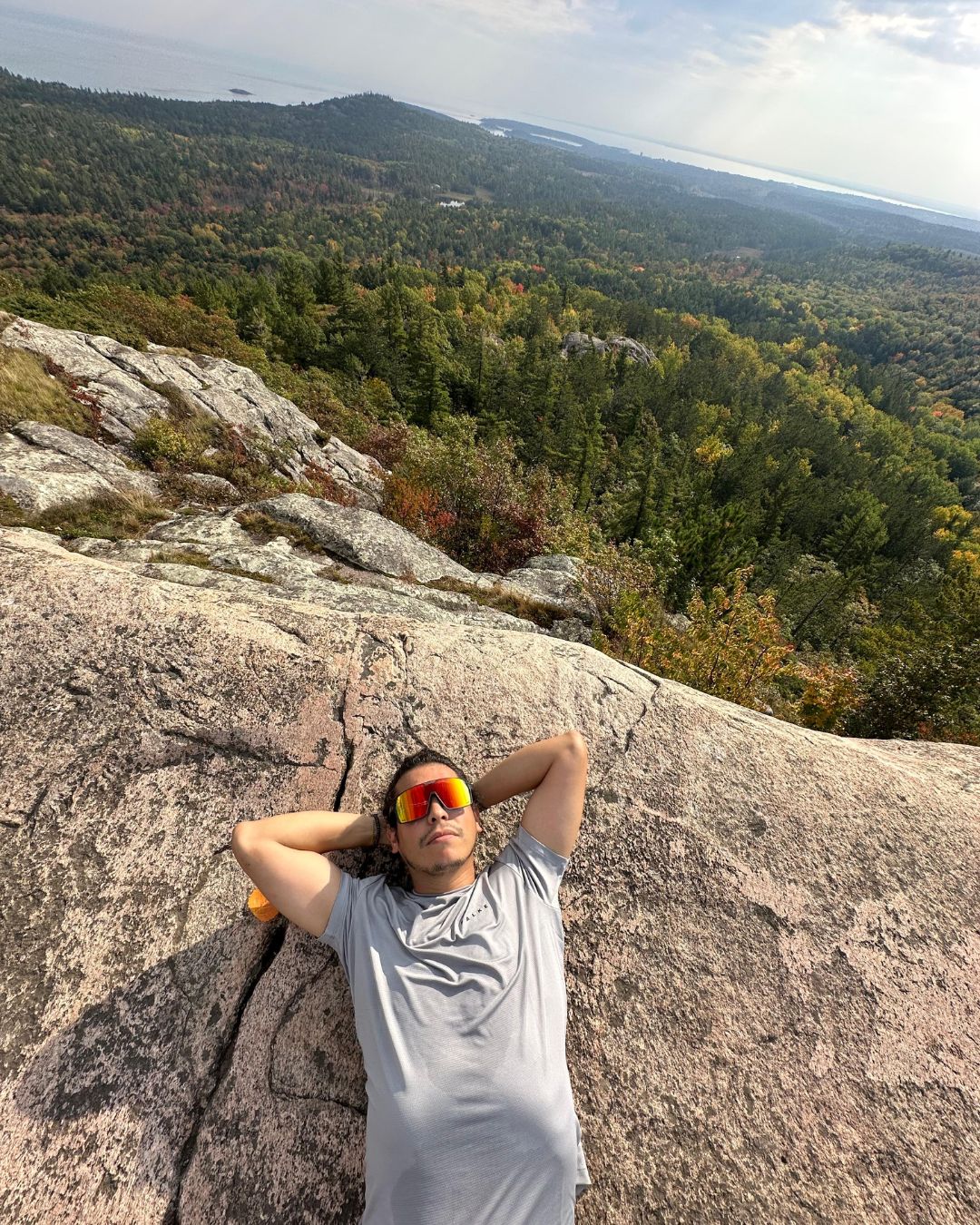

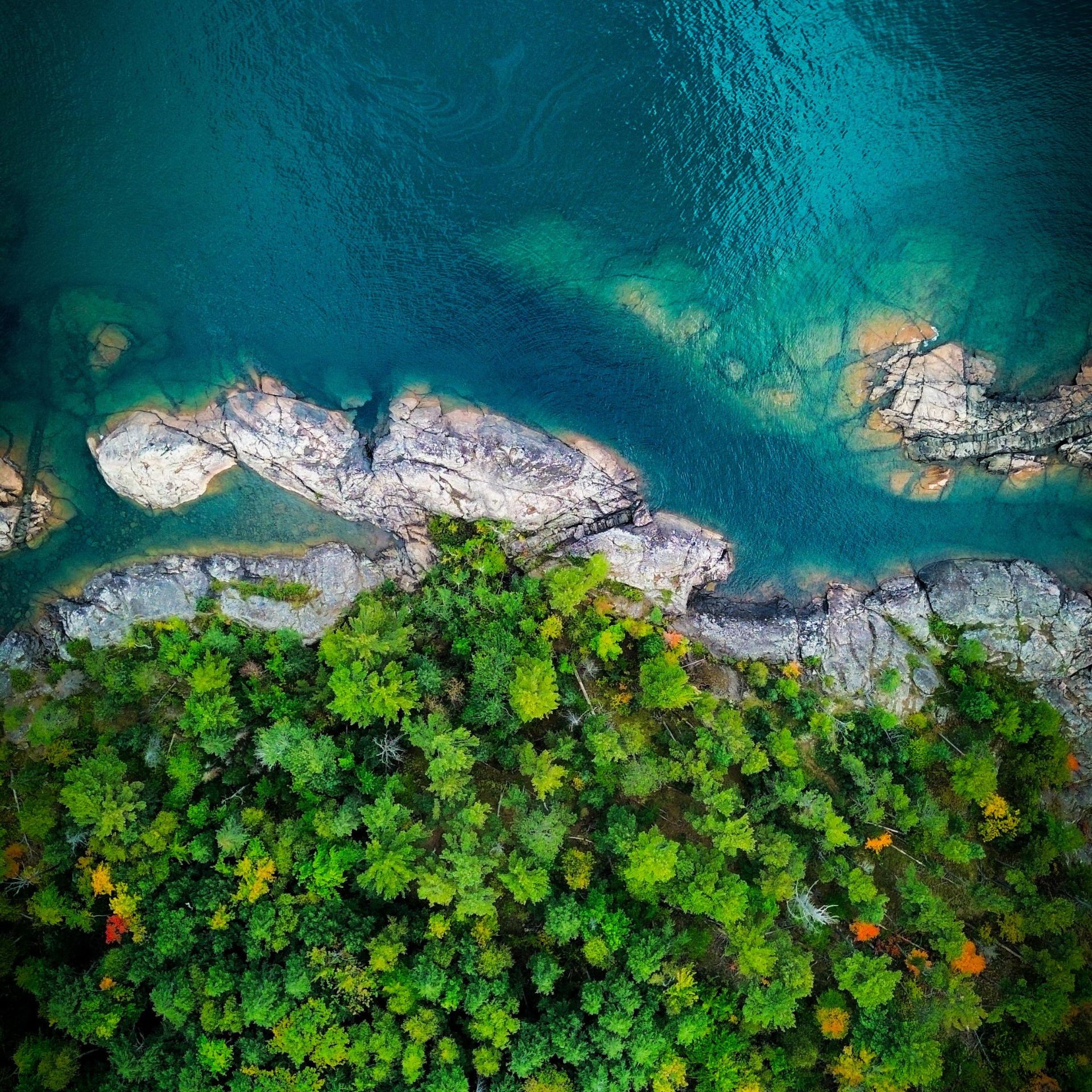

Venezuela felt a bit odd for me. I knew I was in a new country, but the heat, the music, the people, and the vibes were like I was in Colombia. Venezuela feels like the Colombia I grew up in—the one from the 90s where tourism was nonexistent, and infrastructure was limited. Still, no matter how complicated the situation felt, everyone I encountered welcomed me with a smile.

But anyway. This article is not about the similarities of Colombia and Venezuela, but about its odd economy, as navigating Venezuela’s financial landscape requires a minimum understanding of its unique economic circumstances.

After spending time in the country, I’ve gathered insights to help other travelers manage their money effectively in this fascinating yet challenging destination.

Read more: How to Get a Visa to Venezuela as an American

Read more: Is AI going to change photography forever?

Understanding Hyperinflation

Hyperinflation occurs when a country experiences extremely high and typically accelerating rates of inflation, leading to a rapid erosion of the real value of the local currency. Essentially, prices for goods and services rise uncontrollably. Venezuela is a prime example of this economic phenomenon. Over the past decade, the country has experienced hyperinflation, with prices increasing by thousands or even millions of percent annually.

To put it simply, imagine going to buy a loaf of bread. One day it costs 1 bolivar, but the next week it costs 10 bolivars, and by the end of the month, it might be 100 bolivars. This dramatic increase makes it nearly impossible for people to keep up with the cost of living, as their wages do not increase at the same rate as prices.

This means, at some point, people try to buy everything months in advance or try ways to stop depending on this product anymore.

The Impact of Hyperinflation in Venezuela

Venezuela’s hyperinflation has led to a severe devaluation of its currency, the bolivar. As a result, the government has reissued new currencies multiple times, each time knocking off several zeros in an attempt to make transactions more manageable. Despite these efforts, the bolivar continued to lose value rapidly, leading many Venezuelans and visitors to rely heavily on foreign currencies, primarily the US dollar, for daily transactions.

Today, everything is done in US Dollar and the Bolivar became more a currency at the brink of disappearance.

Read more: How to get around in Venezuela

Read more: Everything You Need to Know About a Safari in Venezuela

Using Bolivares in Venezuela

First of all! DO NOT EXCHANGE MONEY INTO BOLIVARES IN VENEZUELA!

I know. This is some kind of natural instinct of a traveler to exchange money at the arrivals terminal. However, everything in Venezuela works with the US Dollar and if you have an American card or a card with USD on it, you don’t even have to worry at all about currencies.

When it comes to the Bolivar, Venezuela has had several versions of its currency over the years, each one an attempt to curb the effects of hyperinflation. The most recent version is the bolivar soberano (sovereign bolivar), introduced in 2018, which replaced the bolivar fuerte (strong bolivar) at a rate of 100,000 to 1. Currently, the sovereign bolivar exists in denominations ranging from 2 to 100 bolivars. However, due to continued devaluation, even these bills often hold little value.

Current Conversion Rates

As of now, the conversion rate fluctuates widely, but it’s approximately 1 USD to 40 bolivars. This can also change from one day to another or if you exchange your currency at an official spot, or at the black market.

This sounds very odd, when you think about that the highest bill is 100 bolivars – 2,5 US dollars only.

Read more: How to be connected at all times in Venezuela

Read more: All You Need to Know About Trip Cancellations and Travel Insurances

Using US Dollars in Venezuela

Venezuela has become heavily dollarized in recent years. This means that while the bolivar is still the official currency, the US dollar is widely used and often preferred. Small bills are crucial for transactions, as breaking larger denominations like $50 or $100 can be challenging, though it’s generally possible for larger purchases such as hotel bills or supermarket shopping.

During my stay, I primarily used US dollars and carried around $20 in one-dollar bills and $100 in ten-dollar bills. Contrary to some blogs suggesting travelers carry $500 to $1000 in small 1 and 5 US dollar bills, I found this to be unnecessary.

NOTE: Unlike in some other countries like Burma or Turkmenistan, the bills don’t need to be sharp new, and US coins are not accepted.

Using Credit Cards in Venezuela

American Express is not accepted at all in Venezuela, but I had a pleasant experience using my Mastercard throughout the country. It was accepted everywhere I went, and even though my Revolut Visa card wasn’t, I was prepared with three different cards: a Revolut Visa, and two Mastercards, one credit and one debit. This strategy ensured I always had a working payment method.

Interestingly, I could also pay with my phone in some places, and compared to Berlin, Germany, using credit cards in Venezuela was easier. However, withdrawing money from ATMs is not advisable due to the “official” exchange rate and additional ATM fees. More on that later.

Read more: Venezuela’s Little Germany, Colonia Tovar

Read more: Everything you need to know about the UK ETA

Exchanging Money and the Venezuelan Black Market

First of all, don’t worry. It sounds less dramatic than it first looks like. Venezuela’s black market for currency exchange arises from the significant difference between the official exchange rate and the parallel (or black market) rate. For travelers who primarily use USD, this discrepancy might not be very noticeable. However, for locals, it makes a significant difference in their daily lives.

In practical terms, exchanging money on the black market can offer a much better rate than the official one, making it a preferred method for both locals and informed travelers. The key is to ensure you’re dealing with a trustworthy source to avoid potential scams.

KEEP IN MIND: This section is mostly for a better understanding about the economy and the situation for Venezuelans. However, as I mentioned already a few times. USE ALWAYS USD. That way you won’t deal at all with the black market and you get some stress easily out of your head.

How Expensive Is Venezuela?

Venezuela’s economy presents a stark contrast between those affected by the crisis and those who aren’t. Those who aren’t affected continue to live relatively normal lives, albeit with higher costs. They still have 5 Dollar cocktails on the weekends and purchase gas at around 50 cents a liter.

For the average Venezuelan, who was unfortunately affected by the economy, the situation is completely different. They shop at places where goods are subsidized, such as gasoline, food, and basic needs. For example, subsidized gasoline costs $3 for 120 liters. Sounds cheap, right? Well, these people have to cue the whole night to get it and with a salary that typically live on extremely low incomes, sometimes as little as $10 a month, paying 30% of the salary in gasoline is extremely hard.

For tourists, Venezuela can be quite expensive, particularly when it comes to anything related to tourism, such as tours, car rentals, and transfers. For example, you can find an arepa (a traditional Venezuelan dish made from cornmeal) for as little as 20 cents, while next door it might cost $8.

Of course, people with low incomes can’t even afford this 20 cent arepa and prefer to always cook at home.

NOTE: I found in July 2024 Venezuela is very expensive—possibly the most expensive country in South America, including the Guyanas. The hope is that the economy will stabilize in the near future, making travel more accessible and affordable for everyone.